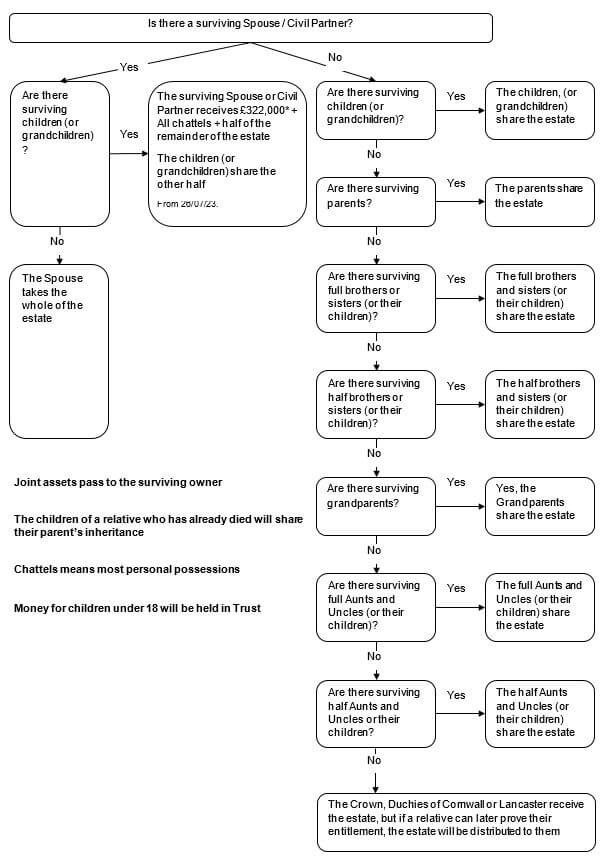

Yesterday the government changed the ‘statutory legacy’ sum from £270,000 to £322,000, which means if a person dies without a will, in addition to being entitled to their personal effects, their spouse or civil partner will automatically receive up to £322,000 worth of assets from the deceased’s estate, with the remaining sum split 50/50 between the surviving spouse/civil partner and any children.

If there are no children then the surviving spouse/civil partner will automatically inherit everything. But this is only applicable to those who are married or in a civil partnership, and doesn’t include cohabiting couples.

For estates worth less than £322,000, the surviving spouse/civil partner will inherit it all. For estates over the new threshold, a split in inheritance could lead to issues for those left behind.

With the cost of living crisis and an increasing number of second marriages, blended families and unmarried couples, an estate that is distributed under intestacy (without a will) is more vulnerable to costly challenges and claims from dependents, or those who were given promises of inheritance.

Our Associate Alistair Spencer said: “We’re seeing more and more disputes based on broken promises and involving second marriages. Children often feel aggrieved if the home they grew up in is left solely to their step-parent, and likewise surviving cohabiting partners can be forced to effectively challenge the intestacy rules by bringing a claim against their late partner’s estate, if it means losing half of their home to their deceased partner’s children”.

“With all this in mind, it is critical for families to have an open and honest discussion with their loved ones while still alive to avoid any confusion and financial misunderstanding when they eventually die. All too often the cases we deal with arise from a lack of communication, misunderstanding or incorrect assumptions of the law that leaves people without money they were depending on.”

Updated intestacy rules